Blog

Ethereum Portfolio Management

What do allocators want? What does Ethereum need? How do we balance confilicting objectives?

Kits: Development, Testing and User Flows

Our vision for building with and using Arbiter as a kit for Ethereum applications.

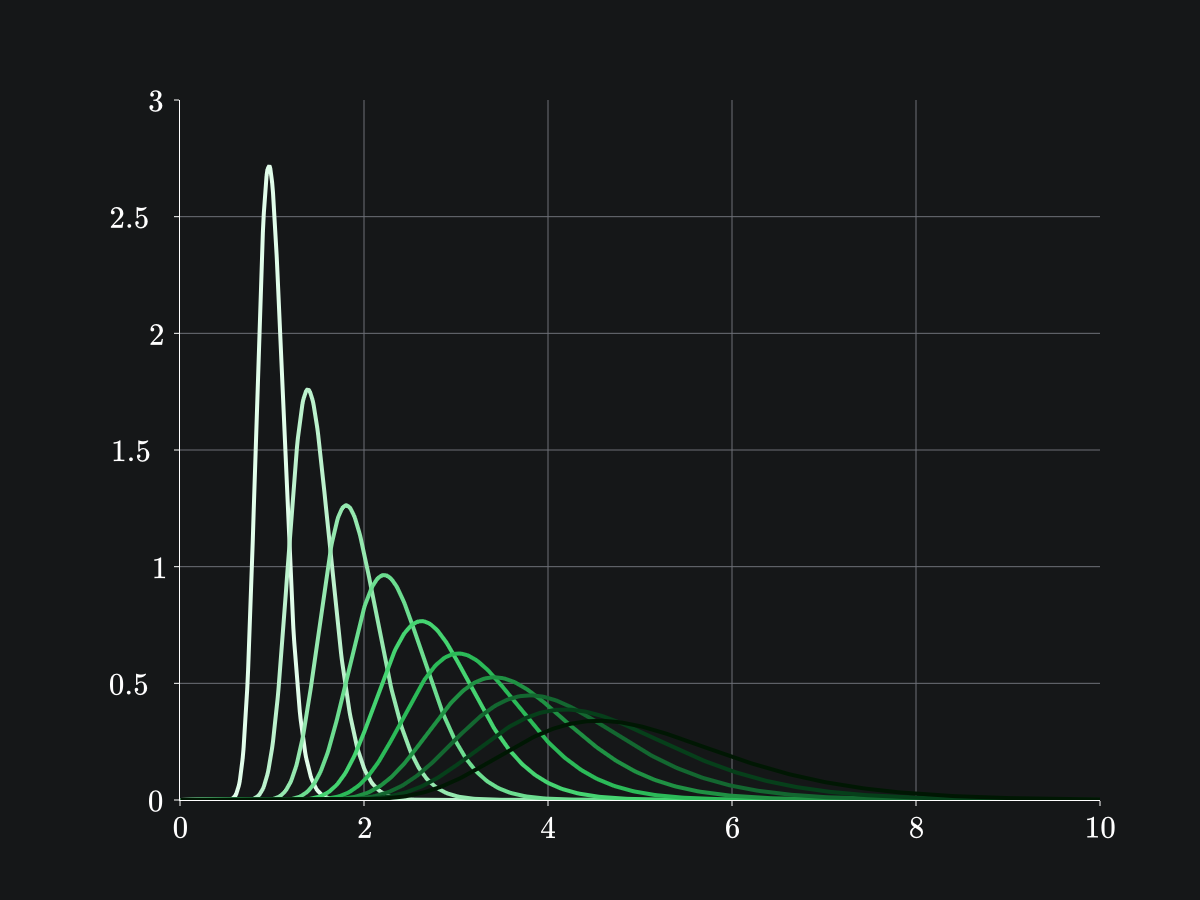

DFMM Strategies: Automating Portfolio Management

A practical guide to how DFMM strategies construct expressive and dynamic automated portfolios.

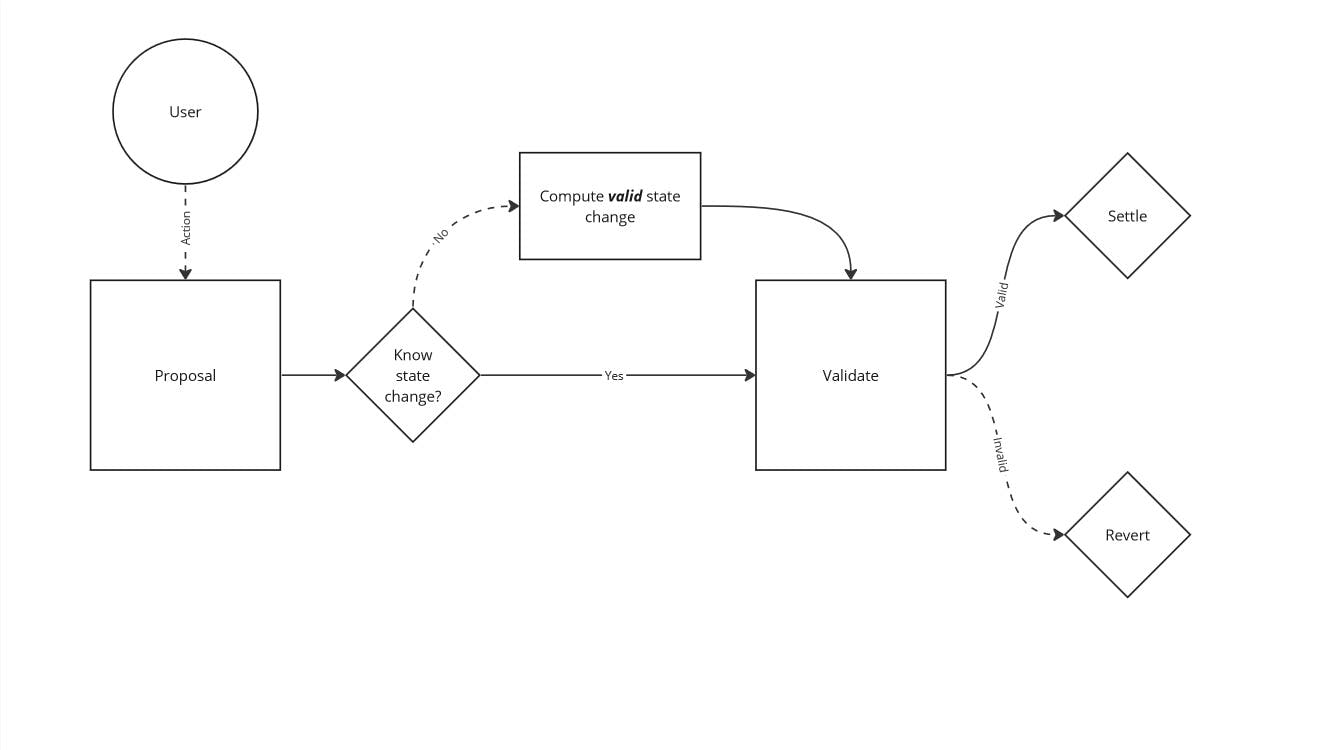

Dynamic Function Market Makers

A formal overview of Dynamic Function Market Makers.

Portfolio: A New Asset Management Primitive

A non-custodial protocol for managing portfolios of assets that use customized strategies.

Arbiter v0.4.0 and Arbiter Core v0.6.0

This release focuses on a number of quality of life improvements and new features.

Primitive x Umbral

Umbral will be using Primitive’s open source EVM logic simulator tool, Arbiter, to conduct holistic economic audits, protocol parametrization and smart contract simulation.

Arbiter-Core Release v0.5.0

What we've added, what is planned, and how we will do it.

Arbiter Release v0.3.0

This release includes a full rewrite of the middleware interface over REVM, and we are very excited to share it with you.

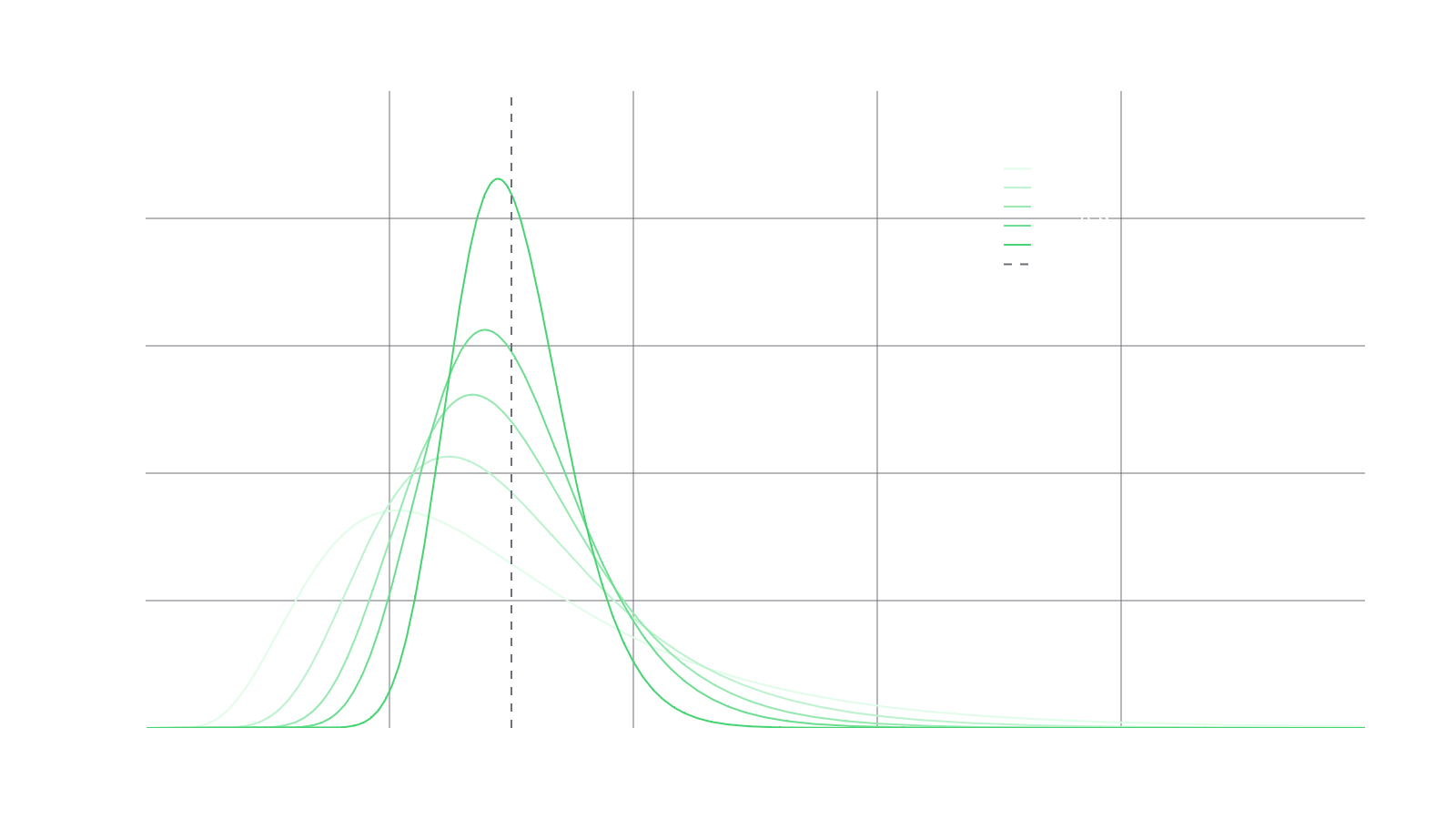

Portfolio Management: Fee Generation in AMMs

In this blog post, we will explore a more nuanced aspect of liquidity provision in a CFMM: how fees are generated on the CFMM and how does your liquidity distribution affect that? Our aim here is to provide an accessible yet comprehensive explanation of fee growth in a CFMM and how path dependency plays a crucial role within the process.

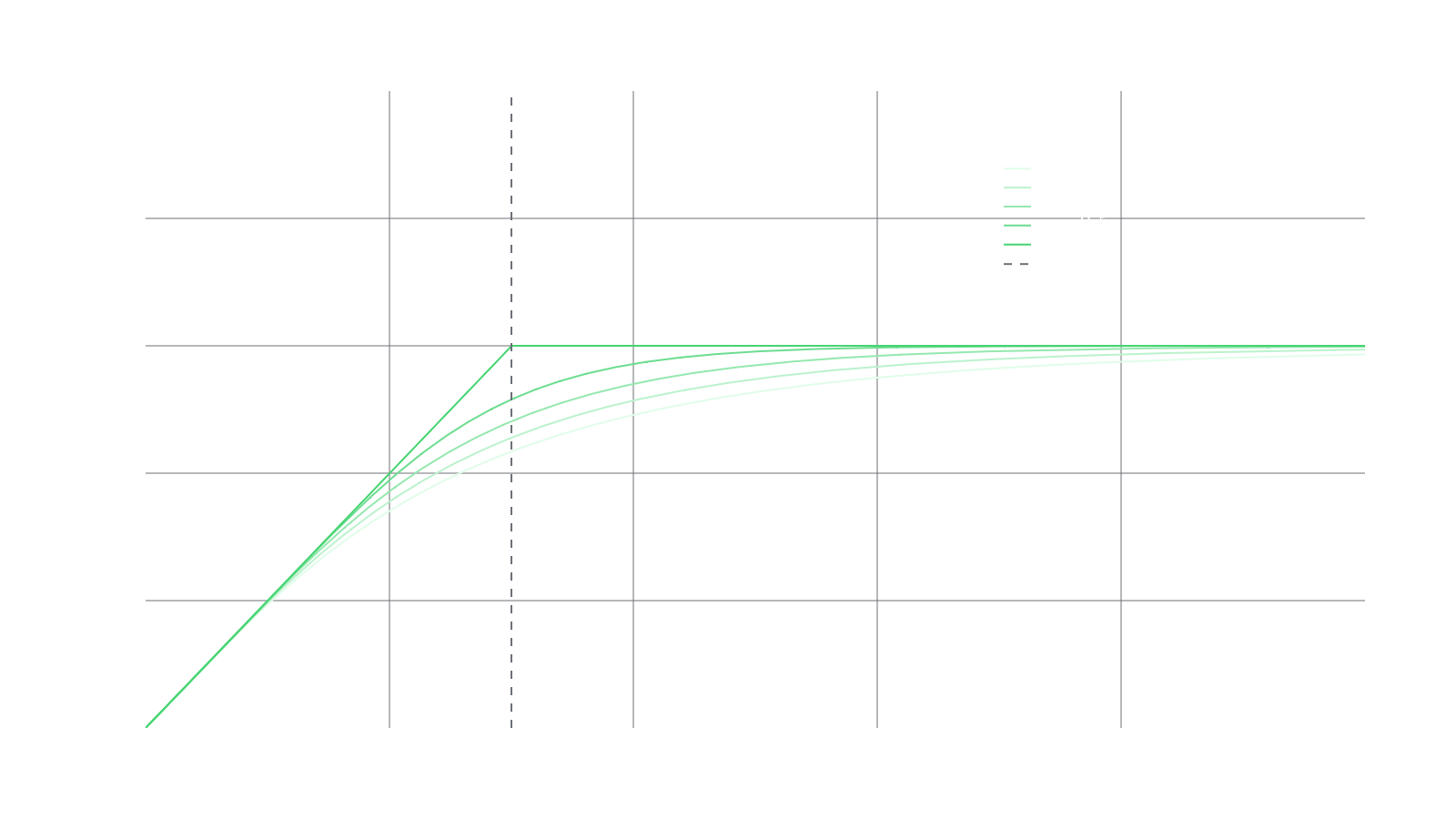

Portfolio Management: Value Functions and LP Shares

LP shares in CFMMs can be thought of as autonomously managed portfolios.

Introducing Arbiter v0.1.0

Today we are excited to announce our beta release of Arbiter, a fast analysis tool with EVM parity

Introduction to On-Chain Portfolio Management

In this article, I will outline two key use cases for Replicating Market Makers (RMMs) and introduce a method for recovering a trading function based on a desired liquidity distribution. I then show how this is exactly the technology we need for passive portfolio management and how Primitive Portfolio utilizes it..

Portfolio Pre-release

Today we are unveiling Primitive’s newest protocol called Portfolio.

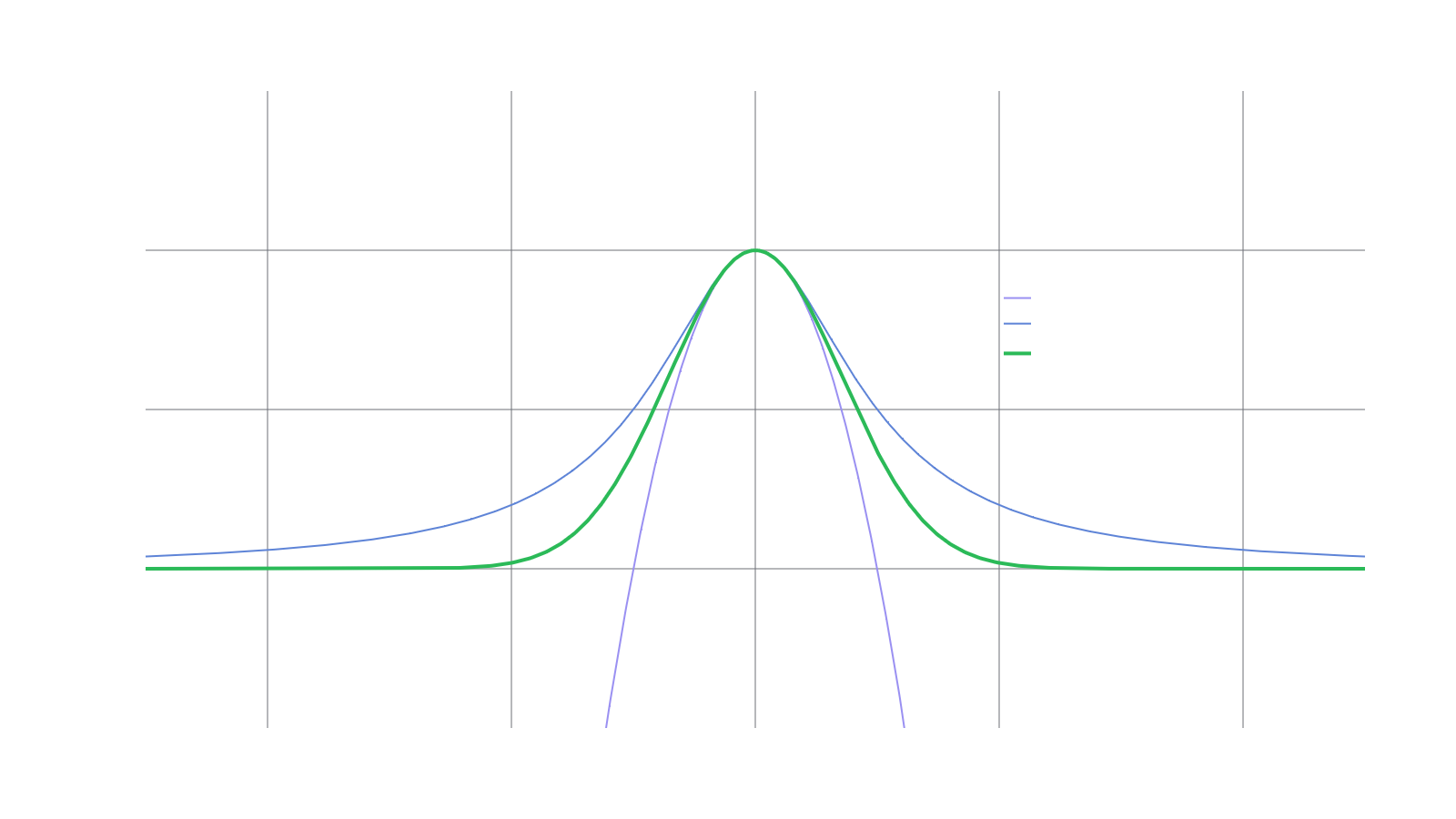

Solstat: A statistical approximation library

Solstat is a precise and efficient statistical approximation library for Solidity.

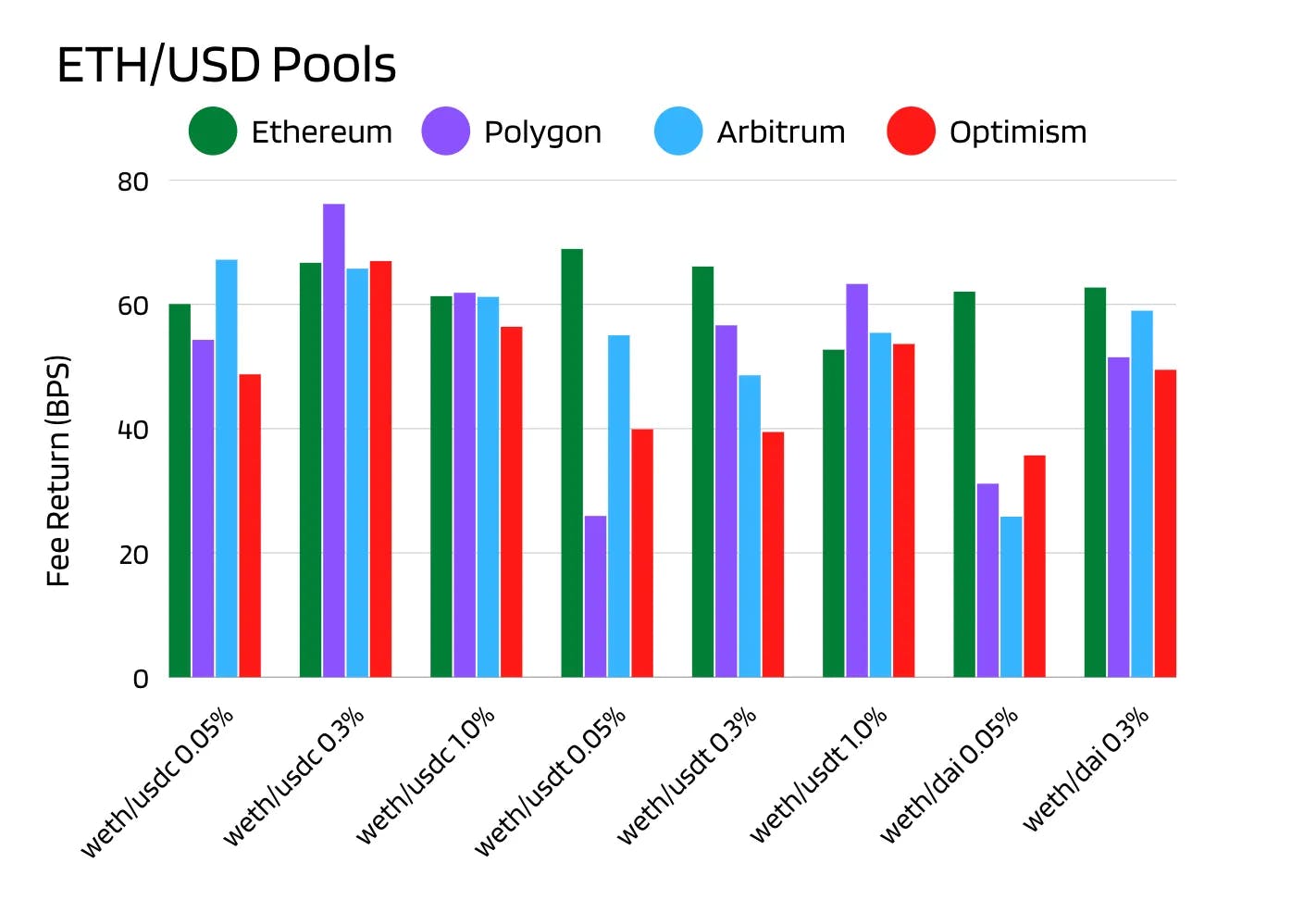

Are Layer 2 Networks Good for Uniswap Liquidity Providers?

Liquidity Providers (LPs) using Uniswap V3 should ask themselves whether bridging to a layer 2 network can generate more fees than staying on Ethereum.

Gamma Exposure for Liquidity Providers Leads to Loss-Versus-Rebalancing

This post compares DeFi LPs and TradFi MMs and connects the dots between LVR and GEX. We discuss how market designers, crypto traders, LPs and quants can build positions to reduce the GEX loss vector. By understanding GEX and LVR, LPs can try to predict how to best manage their positions.

Primitive Arbitrage

In this piece, we show searchers and software engineers that it’s fairly simple to calculate the optimal arbitrage for making a profit on RMM-01, Primitive’s Replicating Market Maker (RMM).

RMM-01 Math Approximation Error

On September 8, 2022, at 06:30 UTC, a liquidity pool in the Primitive RMM-01 protocol experienced a pricing issue due to a specific situational error in the math approximation functions. No user funds are at risk.

Early Sunset for RMM-01

On September 8, 2022, a liquidity pool in the Primitive RMM-01 protocol experienced a pricing issue. No user funds are at risk because once the pool expired, there was no way to exploit the pool’s pricing; however, we recommend all users remove 100% of their liquidity from any outstanding RMM-01 positions.

Primitive Raises $9 Million in Series A Funding to Build AMM Discovery Platform

Primitive will use Series A funding to build AMM discovery platform that broadens accessibility to liquidity provision.